The Overlooked Role of Financial Planning in Business

Running a business comes with no shortage of responsibilities. From managing staff and operations to overseeing growth strategies, many owners find themselves with little time to focus on their own financial security. Yet personal and business finances are deeply connected. This is why having a professional Financial Planner is not a luxury but a necessity for business owners.

Balancing Business and Personal Finances

For many entrepreneurs, the majority of their wealth is tied up in their business. While this creates opportunity, it also carries risk. A Financial Planner helps business owners:

- Separate personal and business goals so that one does not compromise the other

- Create tax-efficient strategies to protect profits

- Manage cash flow effectively to support both business investment and personal wealth building

Protecting Against Risks

Unexpected events such as illness, market downturns, or staff changes can threaten the stability of a business. A Financial Planner ensures proper protections are in place. This includes:

- Insurance planning for income, assets, and key staff members

- Contingency strategies to manage disruption

- Succession planning to safeguard the future of the business and family wealth

Planning for Growth and Exit

A successful business journey involves not only building wealth but also preparing for the eventual exit. Whether the plan is to pass the business to the next generation or sell it, a Financial Planner helps ensure the best possible outcome. Owners benefit from:

- Retirement planning that reflects both business and personal goals

- Exit strategies that maximise value and minimise tax liabilities

- Wealth diversification so personal finances remain secure after stepping away

Why Independent Advice Matters

While accountants and solicitors play important roles, Financial Planners provide a holistic view. They look beyond compliance and focus on the long-term picture. Independent advice ensures decisions are made with the owner’s best interests at heart, free from outside agendas.

Final Thoughts

Business owners often put the needs of their company first, but long-term success also depends on securing their own financial well-being. A dedicated Financial Planner ensures both personal and business goals are aligned, protected, and achievable.

Book a confidential consultation with Chartered Capital today and take the first step toward a stronger financial future.

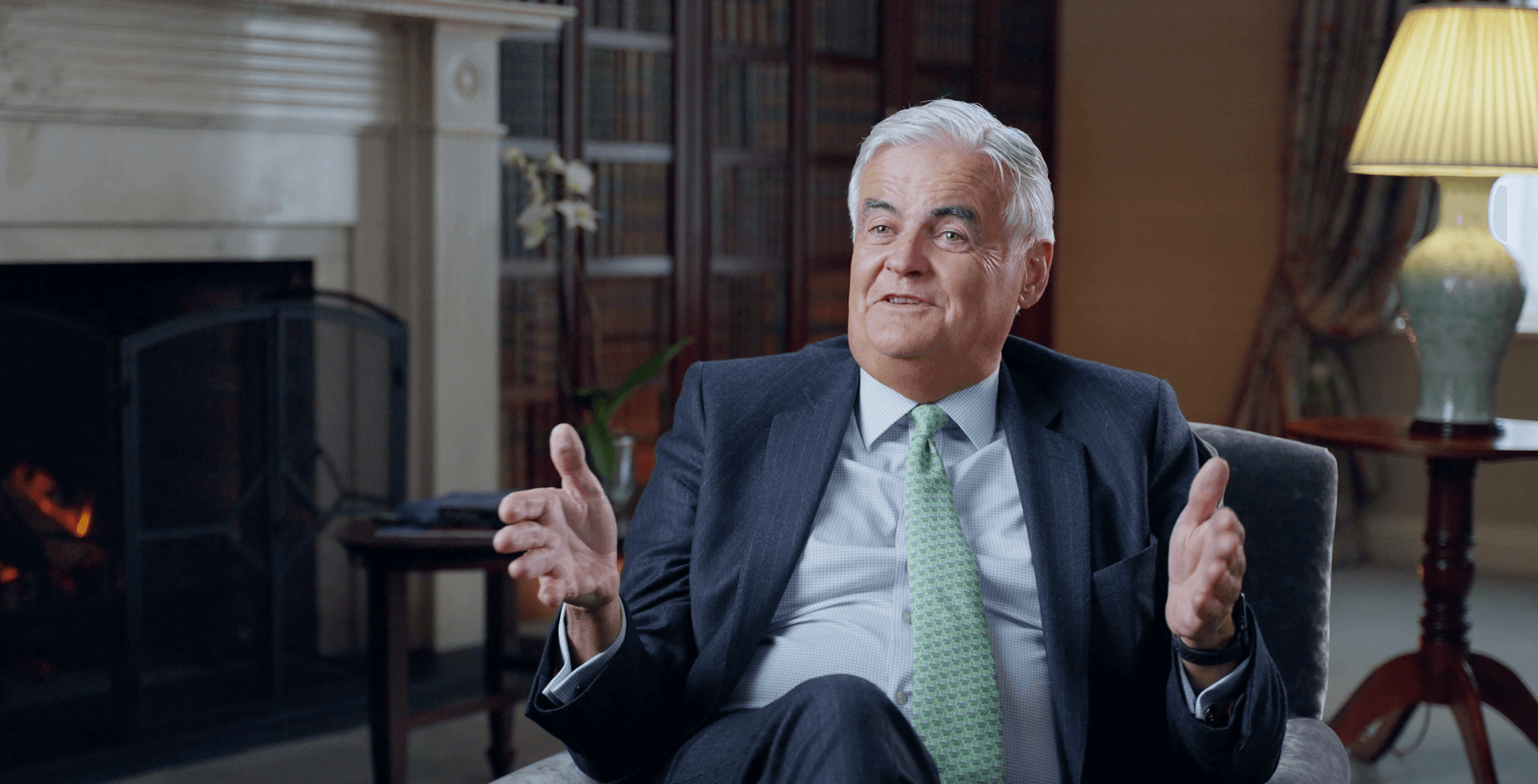

In Their Own Words