On the evening of 12th March 2020, then-Taoiseach Leo Varadkar addressed the nation with a message that signalled a time of change. Ireland, like the rest of the world, was facing an unprecedented challenge with COVID-19. Markets reacted sharply, businesses had to adapt, and uncertainty was high. But as we look back five years later, one thing is clear: uncertainty is not new, and history has shown us time and again that resilience and patience are key to long-term success.

The Market’s Resilience

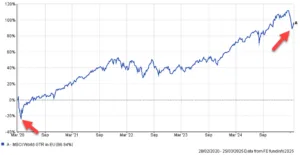

The initial reaction to the pandemic was dramatic. Global stock markets plunged in March 2020, with the S&P 500 suffering one of its steepest declines in history. But in the months that followed, markets rebounded strongly, reaching new highs in the years to come. Investors who stayed the course, rather than succumbing to panic, were rewarded.

This pattern isn’t unique to the COVID era. Uncertainty has always been a part of investing. Whether it was the Global Financial Crisis of 2008, Brexit, or geopolitical tensions, markets have demonstrated time and again that they can recover and thrive.

New Uncertainties, Same Principles

Fast forward to today, and new uncertainties dominate the headlines. The political landscape in the United States is shifting as the Trump administration returns to the White House, bringing potential policy changes that could impact global markets. Interest rates remain a hot topic, as central banks navigate inflationary pressures. Yet, if history has taught us anything, it’s that these uncertainties should not derail a sound investment strategy.

The Power of a Long-Term Perspective

Investing with a long-term mindset helps cut through the noise. Those who reacted impulsively to short-term market drops in 2020 likely missed out on the recovery that followed. The same principle applies today. Successful investors focus on fundamentals, diversify their portfolios, and remain patient through volatility.

At Chartered Capital, we encourage our clients to embrace a disciplined approach to investing. Short-term events – whether political changes, economic slowdowns, or market dips -are just moments in time. What truly matters is staying committed to a strategy built on strong financial principles.

Embrace, Don’t Fear, Uncertainty

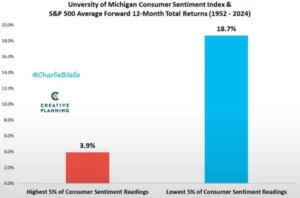

Recent years have shown that markets are always uncertain. However, investors should focus on what they can control: their financial plans, how much volatility they can handle, and their long-term goals. Keeping patient and disciplined is important because historically, investing during downturns often leads to higher returns. Staying adaptable and confident in the market’s strength helps investors deal with future uncertainties effectively. Markets will always have ups and downs, but history has shown that patience and discipline pay off. In fact, investing at the time of highest negative sentiment tends to see much higher returns over the following 12 months (18.7% for the S&P500) than investing when sentiment is at a peak:

Is the current market correction likely a buying opportunity?

Assuming that you

i) have time to ride out any short-term volatility, and

ii) maintain a globally diversified portfolio that consists of the biggest and best companies in the world, then the answer is simply… “yes”!

The graph below illustrates the growth from March 2020 – March 2025, highlighting the benefit of investing during a market correction.

If you need help navigating uncertainty in your investments, get in touch with us to discuss a strategy tailored to your long-term financial success.

In Their Own Words